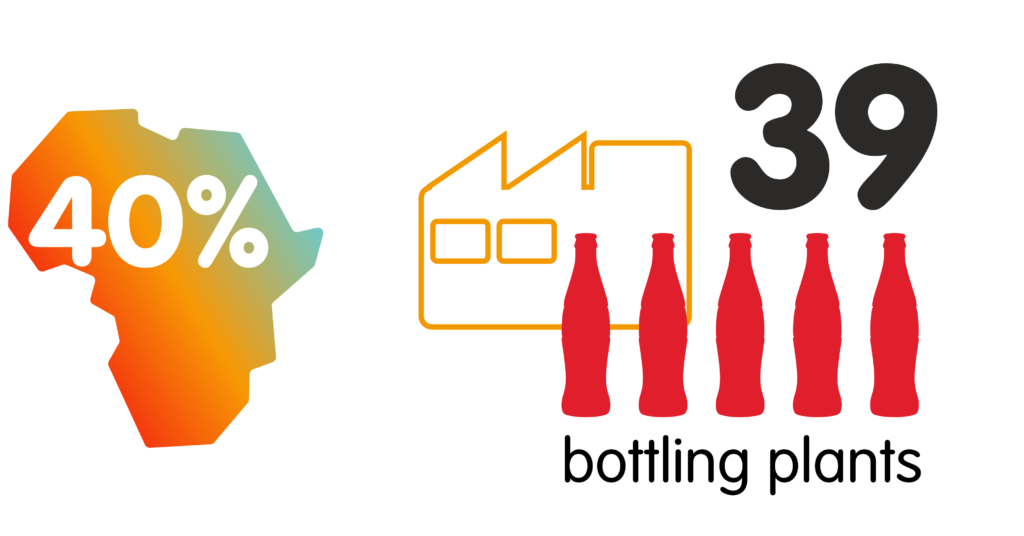

The first Coke was served in Africa in 1928 and currently CCBA accounts for about 40% of all Coca-Cola volumes sold in Africa serving over 735,000 outlets.

CCBA enjoys the number 1 NARTD position in most of our 15 territories, with a theoretical capacity of 1,5 billion unit cases.

We’re investing in the growth and development of our people to enhance their skills and capabilities. CCBA has achieved Top Employer certification in Ethiopia, South Africa, Tanzania, Uganda and the Africa Region for 2024 and 2025.

We have more than

branded trucks

We have more than

branded coolers

The creation of CCBA involved the merger of:

This partnership between two of the world’s most prominent beverage brands, along with their emerging market bottling partners, made for a compelling business proposition. This was recognised by South African regulators when they approved the merger in October 2015. CCBA began operating as a legal entity in July 2016.

In October 2016, Anheuser-Busch InBev (AB InBev) announced it would be combining with SABMiller. In the same month, TCCC announced its intention to acquire AB InBev’s stake in CCBA.

TCCC and AB InBev reached agreement in December 2016 regarding the transition of AB InBev’s equity stake in CCBA. This was concluded in October 2017.

CCBA shareholders now are: TCCC 66.5% and GFI 33.5%.

In April 2021, TCCC and CCBA announced plans to list CCBA as a publicly-traded company. TCCC intends to sell a portion of its shareholding in CCBA via an initial public offering.

Sunil has a strong track record of Coca-Cola bottler leadership having been part of leadership teams in various Coca-Cola bottlers for the last 25 years. Most recently, he served as CFO for The Coca-Cola Company’s Bottling Investments Group (BIG) based in Singapore where he helped transform and turn around its business in the last 5 years. Over the years, he has gained extensive operating experience in business and finance, having worked closely with commercial, supply chain, IT, human resources, and other functions.

Prior to his role with BIG, Sunil has been successful in complex operating roles with the former Coca-Cola FEMSA operations in the Philippines and the company-owned bottler in India. He has more than 30 years of experience with various multinational corporations including the last 25 years in the Coca-Cola system.

Sunil holds a bachelor’s degree from the University of Delhi and is a qualified Chartered Accountant. He has completed executive programmes at INSEAD Business School in Singapore and the Wharton School of the University of Pennsylvania in Philadelphia.

Importantly, Sunil is deeply focused on people and culture, and this is a very important element in his agenda.

Norton is responsible for Treasury, Tax, Internal Audit, Operational Finance, Group Controlling, M&A and Procurement. Until his appointment to this role, Norton held the position of MD for the Southern Africa Region and has a wealth of experience within the Coca-Cola system on the African and Asian continents.

Prior to the formation of CCBA, he had a distinguished career that commenced in 1990 where he held a number of senior finance positions at SA Bottling and then Coca-Cola Sabco. Some of the countries in which he has lived with his family and worked in include Vietnam, Uganda, Namibia and South Africa.

Aside from his extensive system experience, Norton holds a BCom and a post graduate Diploma in Accounting, Tax, Management Accounting and Auditing. He is a member of the Institute of Chartered Accountants in South Africa and he has also completed the Associated Membership Programme in Treasury Management.

Natasa is an award-winning people leader who is passionate about growing teams and organisations. With 24 years of experience, she brings a wealth of expertise and accomplishments, having led enterprise-wide initiatives behind talent and new capabilities and their integration into HR’s vision and practices.

Natasa joined Coca-Cola HBC in 2006 as HR Service Manager. She was later promoted to Country People and Culture Director where she led a successful transformation of the HR function. In 2015, Natasa launched the Talent CoE, building strong talent teams in the centre and across markets. In 2019, Natasa took over the role of Head of Agile CoE, where she introduced new ways of working and played an instrumental role in developing new structure archetypes for many Hellenic functions.

Natasa holds an MA in Psychology from the University of Belgrade and has continually invested in her personal development through the University of Michigan’s Advanced Human Resource Executive Programme, but also business schools in IEDC, IMD, achieving Agile, Scrum and Lean Sigma Institute certifications.

Gavin leads and manages CCBA’s diverse business operations, ensuring world class customer service and execution capabilities, as well as achieving the consistent delivery of business and performance targets across our markets. In this context, the country MDs and GMs, as well as the Group Growth team, report into Gavin.

He interacts with the leadership teams in each market to deliver operational results. He also works closely with The Coca-Cola Company teams to ensure that marketing and advertising strategies effectively drive transactions and growth of products and services.

Gavin is an accomplished business executive with extensive experience in diverse and challenging markets in the alcoholic beverages and sugar industries.

After working on the initial integration project, Joshua joined CCBA on 1 January 2017 as the IS Governance and PMO Manager, forming part of the senior leadership team.

Prior to joining CCBA, Joshua worked for SABMiller for 16 years and in that period held various senior positions. His last position at SABMiller was Head of IT Strategy and Architecture for SAB (Pty) Ltd.

Under Joshua’s leadership, CCBA shifted to Microsoft solutions including Dynamics 365, Azure, and Microsoft 365 to upgrade finance operations, improve customer engagement, and drive HR capabilities with strong analytics. This has resulted in customer engagement, security, and analytics modules all migrating to the same 3-in-1 platform

Joshua has four children – two boys (Thuli and Wakhile) and two girls (Chantal and Tiro) – and is an avid runner and cyclist.

Alok brings with him a great depth of expertise in manufacturing and logistics, across multiple industries, including automotive, consumer goods, and food and beverages. In his most recent role, as an Executive Director Supply Chain at Hindustan Coca-Cola Beverages, he made significant strides in the function’s digitalisation journey and achieved world class quality, efficiency and productivity standards, which in turn elevated customer service excellence. A passionate focus for Alok is sustainability: particularly water and energy usage optimisation as well as packaging innovation.

Layla joined the CCBA family in 2019 with a mandate to establish the Regulatory Affairs and Public Policy function which is now firmly entrenched in the business. A lawyer by training, she is an adept Public Affairs practitioner, having honed her craft over 24 years.

During this time, Layla developed a successful track record in public affairs and regulatory strategy in multiple regulated and unregulated industries across Africa, leading high performing teams. She also managed successful relationships with senior internal and external stakeholders to navigate the complex and dynamic system of policy development, with the aim of protecting the company’s interests.

While heading up the Regulatory and Public Policy function, Layla drove the creation of a SADC Business Council Extended Producer Responsibility platform, which orchestrates the harmonisation of waste policies for the SADC region. Layla brings this regulatory expertise and a passion for sustainable business practices to the PACS role.

Luiza is a seasoned and well-rounded professional, with a proven track record in the beverage industry. She has led and managed diverse aspects of beverage businesses, including procurement, trade marketing, supply chain, logistics project management, and M&A amongst others.

At CCBA, she has been instrumental in the implementation of major projects. This includes helping the South Africa business take the first major step to fulfil its promise to increase black ownership, launching the landmark Ikageng Employee Share Trust, which offers employees shares and direct economic participation in the business. With the promulgation of the Protection of Personal Information Act in SA in 2020, Luiza was instrumental in ensuring CCBA was compliant by 30 June 2021.

Luiza has a wealth of experience in both emerging and developing markets. She approaches her work with a highly motivated and energetic style of leadership and engagement. She is especially passionate about the development of women in the workplace. She has strong networks and experience across Africa and has the innate ability to drive progress through influence and consultation.

Rakesh has 26 years of experience in General Management, Sales, Marketing, Logistics and Finance in the Coca-Cola bottling system. He holds a Bachelor of Commerce and his focus on growth and leadership in CCBSA’s Commercial function has made him a sought after thought leader in developing and implementing revenue growth and route to market strategies in both modern and emerging markets.

As a leader of CCBSA’s strategic and operational customer management, he recently achieved the #1 ranking across FMCG companies in the Advantage survey for two consecutive years. Having started his Coca-Cola system journey as a young temporary Filing Clerk at ABI in 1997, Rakesh’s drive to succeed is inspirational testament to the power of self-development within our system that supports and rewards a consistent work ethic, self-empowerment and a growth mindset.